Natural Gas Forward Prices Slip as Weather Warms, but War-Led Volatility Continues

Even with Russia’s war in Ukraine raging, U.S. natural gas forward prices retreated a bit during the March 24-30 period amid thawing spring temperatures and moderating demand, NGI’s Forward Look showed.

Benchmark Henry Hub set the tone for the week, with volatility still heightened as global energy markets continued to respond to Russia’s invasion of Ukraine. With temperatures in the 70s and 80s taking hold across the southeastern United States though, gas demand in the Lower 48 was declining and expected to remain soft for the foreseeable future, pressuring the front of the curve.

After huge price swings in both directions throughout the period, the Henry Hub April contract ended Wednesday 7.0 cents lower at around $5.340/MMBtu, according to Forward Look. Prices remained strong further out the forward curve, however. Production was still lagging late 2021 highs, with export demand running rampant amid the political turmoil and domestic inventories warranting a steep refill throughout the summer.

May forward prices were up 16.0 cents through the period to reach $5.606, while the full summer strip (April-October) was up 14.0 cents to $5.630, Forward Look data showed. Winter 2022-2023 prices averaged 18.0 cents higher at $5.732.

With gas prices well above the $5.00 mark, EBW Analytics Group noted that technical drivers play an increasingly important near-term role in a price-inelastic market. The firm cautioned that there would be minimal changes in near-term supply or demand because of the recent price gains – or declines – enhancing the role of technicals to move Nymex futures pricing without the encumbrance of physical flows.

“This dynamic inherently enhances price volatility while increasing susceptibility to significant price swings,” EBW senior analyst Eli Rubin said.

Has The War Changed Pricing Behavior?

Bulls have enjoyed a long stretch of mostly upward momentum since Russian forces moved into Ukraine in late February. The invasion sparked a wave of economic sanctions against the Kremlin, and Europe is feverishly working to wean itself off Russian gas. U.S. liquefied natural gas (LNG) exports, in turn, have been near record levels over the past month as more supply is sent to Europe to aid in its efforts to meet demand and replenish inventories ahead of next winter.

However, while U.S. LNG terminals are running near maximum capacity, exports to Europe are not likely to ramp up much more this year, despite the crisis at hand. NGI data showed feed gas deliveries to U.S. export facilities sitting Thursday at around 13.90 Bcf, up slightly on the day but off a bit from the 14.22 Bcf mark a week ago.

Meanwhile, continued price volatility is likely as long as the war continues. On Thursday, Germany was preparing for the possibility of a sudden plunge in natural gas supplies from Russia, with European prices skyrocketing after the country initiated the first of three levels in its emergency natural gas plan.

There were concerns that Russia could cut off supplies to the continent if payments are not received in rubles from “unfriendly countries” following an order by President Vladimir Putin. The ruble suffered immediately following the wave of sanctions imposed by Western governments.

The implications of the war have upended the global gas market, with U.S. prices feeling the knock-on effects from the battle over molecules outside Russia. Mobius Risk Group pointed out, however, the continued pull on U.S. LNG cargoes does not appear to be factoring into some domestic pricing locations. Since production remains relatively flat in the lower 90 Bcf range, and there is little spare takeaway capacity from the Permian and Appalachia basins, “a relatively new dynamic has emerged,” it said.

Sharp downward movement in West Texas and Appalachia has opened up “very lucrative” transport spreads to the Gulf Coast, according to Mobius. Since there still isn’t any new supply on which merchant shippers can rely, they are more apt to secure molecules at their respective receipt points in the producing areas, Mobius said. Merchants subsequently are selling the downstream basis location, or delivery point, to secure “handsome” profits on their transportation.

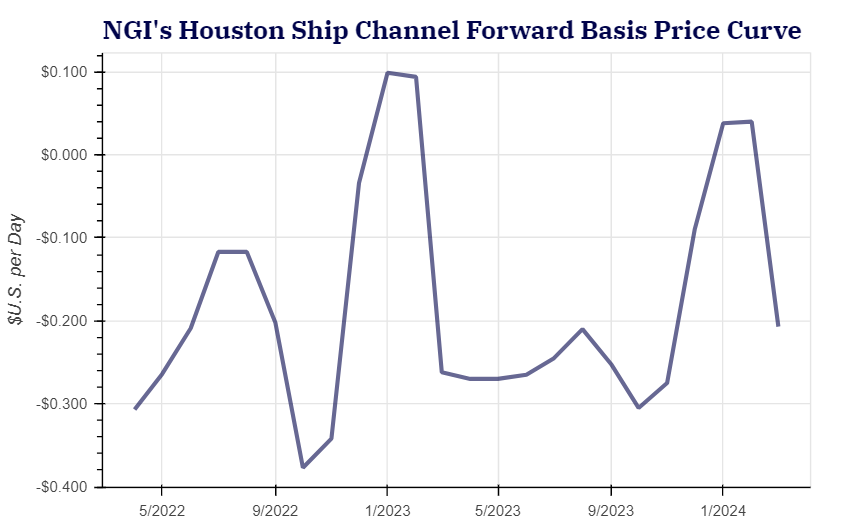

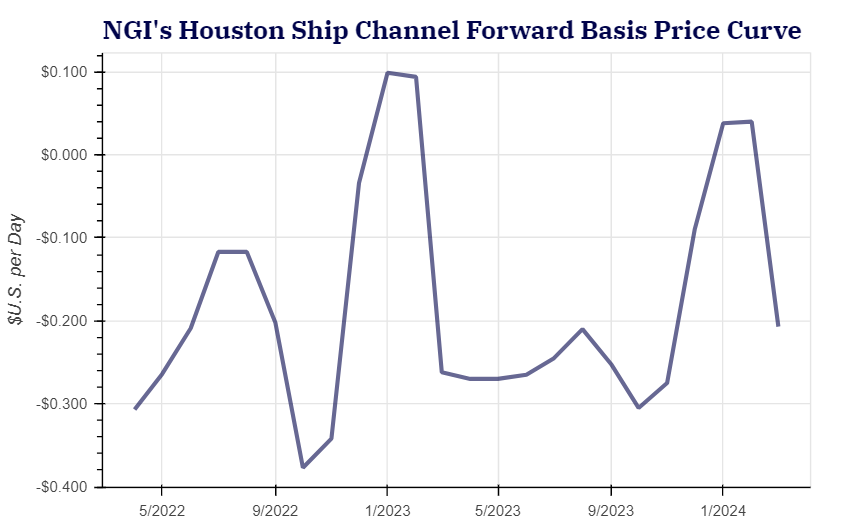

Locations such as Houston Ship Channel (HSC), Columbia Gulf Mainline and NGPL TexOk have seen their summer 2022 curves trade significantly lower than they would normally.

Looking at the HSC, for example, summer basis as of Wednesday (March 30) stood at minus 23.0 cents, according to Forward Look. This was down 6.0 cents from a month ago and down 15 cents since the start of the year.

Summer basis prices at the Permian Basin’s Waha Hub, meanwhile, stood Wednesday at minus $1.01, Forward Look data showed. At the start of the year, Waha’s summer strip was only 67.5 cents back of Henry Hub.

“The market has a tendency to see a price change and then fit a story to it,” Mobius said. “In this case, the story line is that new supply hitting these markets will be more than they can handle. Yet, daily production data, producer commentary and the Nymex curve suggest otherwise. It will be an interesting summer for regional markets across the country as we are in somewhat uncharted territory.”

Simmering Domestic Supply Worries

Meanwhile, U.S. supply concerns could soon ratchet up based on the latest government inventory data.

On Thursday, the U.S. Energy Information Administration (EIA) reported that inventories for the week ending March 25 rose by 26 Bcf. It was the first injection following the winter season, but did little to improve balances.

At a granular level, stocks barely budged in the East, Midwest and Mountain regions. Pacific stocks increased by 4 Bcf. The biggest change on the week occurred in the South Central region, where salt stocks rose by 13 Bcf and nonsalts increased by 8 Bcf.

Total working gas in storage climbed to 1,415 Bcf, which is 347 Bcf below year-earlier levels and 244 Bcf below the five-year average, according to EIA.

EBW’s Rubin noted that many storage fields can only switch from draws to injections seasonally. As such, last week’s warm-up may have led many storage operators to pull the trigger. This, in turn, likely led gas buyers to the spot market as cold hit the Midwest and Northeast this week and drove up demand.

“As weather warms rapidly, however, this temporary strength may vanish, potentially amplifying the impacts of warming weather on physical market pricing,” Rubin said.

Local distribution companies (LDC) often do not begin planned injections until mid-April, providing bears an additional opportunity to send prices lower in the near term, Rubin said. “While fast-cycling salt storage and marketers are likely to step-in and limit physical market impacts, the lack of either bullish weather or LDC demand reduces near-term upside price risks.”

Nevertheless, over the course of the 2022 injection season, the market must erase the hefty storage deficit versus the five-year average, loosening the market by 1.4 Bcf/d without any immediate market-loosening levers available, according to Rubin.

“Our most likely projections indicate this is possible, with a production boom likely in the latter half of summer and into the fall,” he said. “There is a narrow margin for error, however, and the market may need to ‘see it to believe it’ – suggesting Nymex futures may be slow to move to the downside even if bearish catalysts emerge.”

Published at Thu, 31 Mar 2022 14:41:02 -0700