Spotlight on Southern California as Natural Gas Forward Prices Surge Amid Weak Macro Picture

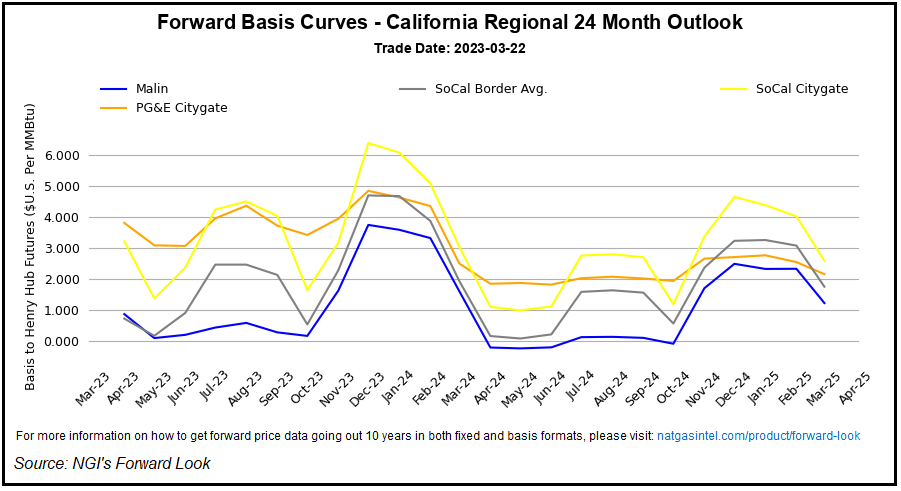

Against a consistent backdrop of lackluster natural gas demand, robust production, lagging exports and unseasonably solid storage inventories, forward prices continued to crumble during the March 16-22 period, according to NGI’s Forward Look.

Natural gas fixed prices declined more than 30.0 cents on average for April, with several U.S. locations recording even steeper decreases for the period, Forward Look data showed. May prices were similarly weak, though the full summer strip (April-October) averaged only one-quarter lower as traders baked in the prospects of at least some heat in the core months of the upcoming season.

With analysts expecting a tapering of production growth in the coming months, along with the return of the Freeport LNG export facility, winter prices slipped even less at 10 cents on average, according to Forward Look.

Amidst the early shoulder-season softness, though, Southern California stood out from the pack as April fixed prices surged 43.0 cents from March 16-22 to reach $5.380.

The gains in the Golden State on their own were not unusual based on the rampant price volatility that has been in place throughout the winter. What’s interesting, however, is that the gains occurred in spite of declining prices elsewhere in California and throughout the western United States.

For example, the SoCal Border Avg. price for April fell 47.0 cents through the period to reach $2.884, Forward Look data showed. PG&E Citygate April dropped 38.0 cents to $5.978, while the notoriously erratic Northwest Sumas saw its April contract plunge 40.0 cents to $2.437.

Kings And Pawns

A quick look at the Southern California Gas (SoCalGas) electronic bulletin board divulged a possible explanation for the April price hike at the SoCal Citygate.

In the SoCalGas northern zone, the company from April 3-28 is planning to curb flows through Line 4000 by 310 MMcf/d for maintenance. In the southern zone, 630 MMcf/d is scheduled to be restricted from April 10-28 on Line 5000 for remediation work. These curtailments coincide with inventory shut-ins at the La Goleta and Honor Rancho storage facilities, which means no gas from these systems may be injected or withdrawn.

Pipeline outages, planned or otherwise, highlight the fragility of the Southern California natural gas market. It has developed over time amid a lack of infrastructure improvements and the shift from fossil fuels. Other factors have further amplified the issues. They include the weather and an increased pull on natural gas in light of low hydro supplies because of the drought.

The result has been historic natural gas price volatility this winter in California, which has drawn the attention of the California Public Utility Commission. Regulators last week launched an investigation into the “extraordinarily high” natural gas prices this winter.

“I feel like I’m playing chess, and the other player gets three moves before I get one,” one California natural gas buyer told NGI. The buyer noted that the timing of pipeline outages can wreak havoc on prices.

For example, SoCalGas on Feb. 14 stated that because of an inline inspection, a pressure reduction was necessary on Line 235 related to identified safety-related conditions. The curtailment, 800 MMcf/d, was to go into effect on Feb. 16. The North Desert Zone also was to be reduced by 280 MMcf/d, according to SoCalGas.

The natural gas buyer said the Line 235 restriction occurred as the market was expecting to reap the benefits of the long-awaited return of El Paso Natural Gas Line 2000. That line returned to service on Feb. 15 after being offline for 18 months.

Is It As Bad As It Seems?

However, NGI’s Josten Mavez, senior energy analyst – and a San Diego resident – said Line 235 was shut down for 18 months following an explosion in October 2017. Given the pipeline’s past troubles, it’s become common for SoCalGas “to take extra precautions.”

A closer look at the gas flows within Southern California, and in particular the northern zone, showed that since the start of this year, Line 235 was flowing only a little more than half of its operating capacity. Altogether, net scheduled volumes in the SoCalGas system were off by only around 6% before Line 235 came back online last week (March 18).

“I would assume anyone on interruptible transportation would be negatively impacted as they would be the first to be cut off,” Mavez said. “Firm delivery customers would still be operating, but at a higher cost.”

Outside of flows into the SoCal Citygate, Mavez said it is unlikely that residential/commercial customers were significantly impacted. “These lines don’t have many bi-directional compressors, making it physically impossible to reroute gas even if operators miraculously gave their blessing to do so. This just highlights the gas infrastructure issues here in California.”

While Mother Nature continues to play games in California, storage inventories in the broader Pacific region, which includes California, Oregon and Washington, have struggled. The latest data from the Energy Information Administration (EIA) may offer some insight into why SoCal Citygate prices have diverged from other California locations.

The EIA said Pacific stocks for the week ending March 17 were flat week/week at 72 Bcf. This is a swift change from the 9 Bcf withdrawn the prior week, even as wet and chilly weather systems continued unabated in the region.

“Are local distribution companies buying their way out, buying gas instead of withdrawing?” the natural gas buyer asked. The buyer said operational flow orders, nearly a daily occurrence this winter, abruptly stopped around March 10. “My immediate thought was that they got it together now, but then we have SoCal Citygate cash hit $14.17 on March 20 (Monday), the highest daily price in the country.”

Given the upcoming pipeline maintenance events, and Pacific storage inventories that sit more than 50% below historical norms, price volatility may stick around a bit longer in California.

Downside Risk For Henry Hub

The scenario could not be more different elsewhere across the Lower 48.

The EIA said total working gas in storage stood at a plump 1,900 Bcf on March 17. This is a massive 504 Bcf above year-earlier levels and 351 Bcf above the five-year average. This followed a net 72 Bcf withdrawal for the week that resulted from frigid temperatures that spanned the Midwest to the East Coast, including deep into Texas.

Another above-average withdrawal is expected in the next EIA report. However, market observers said it may do little to shift overwhelmingly bearish sentiment in the gas market.

EBW Analytics Group noted that towering surpluses in the South Central region, in particular, continue to pose downside price risks. At more than 65% above year-ago levels, healthy stocks could combine this spring with robust renewable energy output to soften power burns.

Likewise, the bulk of production growth is situated in the regional Haynesville Shale and Permian Basin. Although activity may decline in the Haynesville in the coming months, Permian output is driven by oil and is still in the money even with the decline in oil prices.

Finally, pipeline exports to Mexico often subside for maintenance during the spring. A similar outcome could push supplies north of the border and weigh on physical market pricing, according to EBW.

Maintenance at U.S. LNG facilities, which have run full throttle since Russia’s invasion of Ukraine, may also rise alongside the cumulative size of the expanding domestic export fleet. This could further dent natural gas consumption along the Gulf Coast, EBW said, especially if Freeport is not fully in operation.

“Near-term regional risks into the spring may remain to the downside, particularly if unanticipated bearish catalysts emerge,” EBW senior energy analyst Eli Rubin said.

Published at Thu, 23 Mar 2023 14:15:40 -0700