Natural Gas Forwards Rally Amid Nymex Volatility, Late-Season Cooling Demand

Regional natural gas forwards rallied sharply during the Sept. 8-14 trading period, coinciding with a surge in the futures market amid apparent market speculation over impacts to power burns from a potential railroad strike, NGI’s Forward Look data show.

Also bolstered by lingering storage deficits and a bout of late-season cooling demand expected for next week, Henry Hub forwards for October delivery rallied $1.272 to $9.120/MMBtu for the period. That paced week/week gains of $1-plus at most Lower 48 locations.

A swift 83.0-cent surge for the Nymex front month contract on Wednesday evaporated as quickly as it came, as prices pulled back 79.0 cents to settle at $8.324 on Thursday.

The Forward Look data cited in this report accounted for Wednesday’s trading and thus reflected the full force of the broader rally in natural gas markets on the day.

Nymex Volatility

Market speculation about the potential knock-on effects of a railroad workers strike appeared to have a hand in the volatile swings for Nymex futures.

“If you somehow missed the last two trading sessions…you might think nothing at all happened,” NatGasWeather told clients Thursday. One reason for Wednesday’s price surge “seemed to be fears of a possible railroad strike, which could cause supply disruptions, including with coal.

“In such a scenario, the idea is that natural gas burns would be stronger, with less coal available to burn,” the firm added. “In any case, it appears to be a moot point, as news that a strike has likely been averted triggered the start of selling early this morning.”

The latest storage print, a net 77 Bcf injection reported by the Energy Information Administration (EIA) for the week ended Sept. 9, fell to the higher side of expectations. However, the deficit to the five-year average widened slightly week/week to end at minus 354 Bcf, EIA data show.

“While indicative of a looser supply/demand balance, we still are pointed around 3.45 Tcf as an end-of-season storage level, not high enough to have a ton of comfort” in the event of a cold winter, NatGasWeather said.

As for the latest weather picture as of Thursday, after light demand over the weekend, the week ahead is expected to deliver “strong” demand nationally on highs in the upper 80s to 90s over interior portions of the country, the firm said. This includes “the potential for near-record highs in parts of the Midwest and East.”

European Price Caps?

Meanwhile, looking overseas, Dutch Title Transfer Facility prices pulled back earlier in the week amid signs that the European Union (EU) could take steps to cap energy prices, along with “consistent efforts from EU members to ramp up gas storage for the coming winter,” Rystad Energy analyst Zongqiang Luo said in a recent research note.

“Months of geopolitical wrangling have left the European gas market whiplashed, with volatile prices stemming from lack of supply, potential market intervention, and wider uncertainty,” Luo said. “In the view of most experts and policymakers, the gas market is broken — but how it should be supported or fixed is an ongoing conversation with no clear resolution in sight.

“What is certain is that the European gas market is unrecognizable from a year ago,” with prices over the past month traded at levels equivalent to an oil price of $331-588/bbl, the analyst added.

Russian supplies flowing into Europe are down about 80% from year-earlier levels, recently accounting for less than 10% of European gas imports, according to the analyst.

“After the indefinite shutdown of Nord Stream 1 due to the oil leakage discovered during maintenance in late August, Russian pipeline flows via other routes remain relatively stable,” Luo said. Still, the EU moving to impose a price cap on Russian gas “may result in gas supplies from Russia halting altogether.”

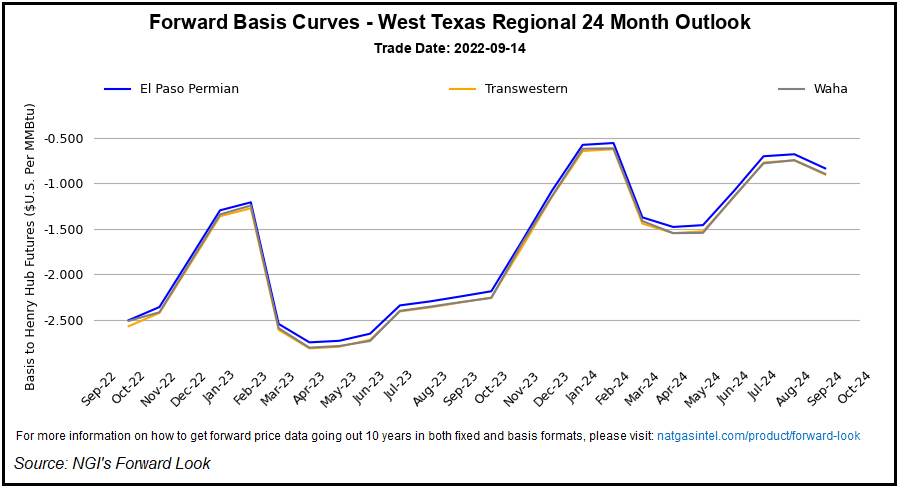

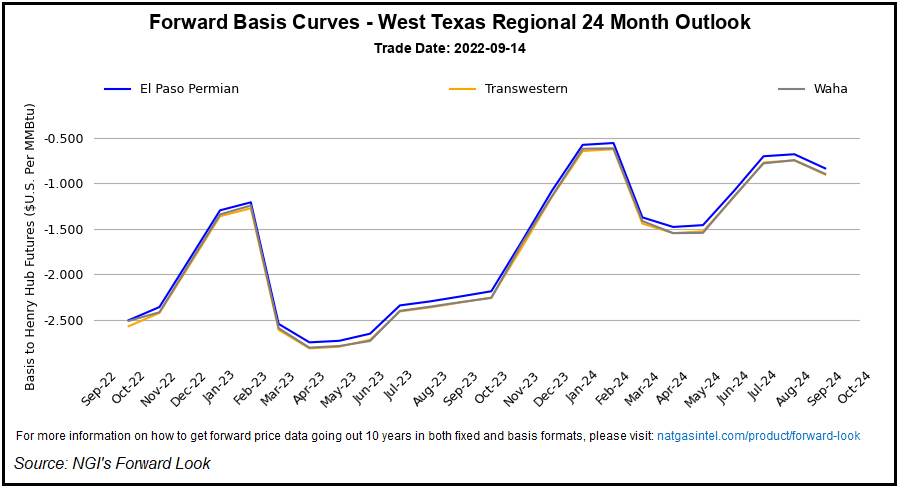

Pressure On Permian Basis

In terms of regional basis shifts in the North American market for the Sept. 8-14 trading period, it appeared to be a case of too much supply for Permian Basin hubs with the market drifting into shoulder season conditions.

El Paso Permian front month basis skidded 37.7 cents week/week to minus $2.503, while Waha ended at minus $2.510, a 37.2-cent swing lower.

Notably, there are more U.S. natural gas rigs in operation than there were at the start of the Covid-19 era in early 2020, EIA observed in a research note Thursday, citing rig data from Baker Hughes Co.

There were 112 natural gas rigs running in the United States in late January 2020. However, that number “continued to fall in the first half of 2020, reaching a low of 68 rigs on July 24, 2020, the fewest in Baker Hughes’s historical data, dating back to 1987,” EIA researchers said.

The oilfield services provider reported 166 active U.S. natural gas-directed rigs as of last Friday, up 54 rigs versus early 2020 levels.

“As natural gas drilling increases in the United States, we expect that production will grow as well,” EIA said. The agency estimated 97.6 Bcf/d of U.S. dry natural gas production for August. That figure is expected to climb to 100.5 Bcf/d by December 2023, according to EIA modeling.

On the topic of production, Western Canada prices couldn’t catch a break for the Sept. 8-14 period, with NOVA/AECO C plunging another $1.515 to end at a whopping $5.595 discount to Henry Hub.

Analysts, including RBN Energy LLC’s Martin King, have pointed to a combination of surging production and pipeline constraints as key factors driving the collapse in AECO pricing.

Published at Thu, 15 Sep 2022 14:42:19 -0700