Natural Gas Forward Prices Slide Further Amid Stubborn Storage Surplus; Balances Remain Loose

Though late-season cold was boosting heating demand across most of the Lower 48, natural gas forward prices continued to decline during the March 9-15 period, according to NGI’s Forward Look.

In a sign that the chilly weather arrived too little too late, fixed price decreases averaged 11.0 cents for the April contract, Forward Look data showed. This was on top of double-digit losses the prior week.

The summer strip (April-October) – heavily influenced by plump, well above-average storage inventories along with robust production – averaged 14.0 cents lower through the period. The winter 2023-2024 strip lost an average 20.0 cents.

“Although the weather outlook remains colder than normal through the end of March, seasonally ebbing demand could still erase 34 gas-heating degree days” from now to the last week of the month, according to EBW Analytics Group.

The April weather pattern, meanwhile, remains unclear. The European data maintained a rather cold and bullish outlook, while the Global Forecast System trended warmer, with subfreezing air retreating to near the Canadian border.

Storage Dynamics

Even if it doesn’t appear to be packing the same punch as January or February cold, the crisp March pattern stands to offer at least some support to the gas market.

After record warmth in January and February, storage inventories have swelled, leaving stocks sitting at unsustainably high levels weeks ahead of the traditional injection season. The result is a brief dip below $2.00 earlier this month and projections for sustained low prices throughout this year.

On Thursday, the string of below-average storage withdrawals continued. The U.S. Energy Information Administration (EIA) said stocks declined by only 58 Bcf for the week ending March 10. This compared with last year’s 86 Bcf pull in the same week and the 77 Bcf five-year average.

“I am showing this report to continue to look loose versus last year weather-adjusted – 3 Bcf/d-plus loose,” said Enelyst’s Het Shah, managing director of the online energy chat.

By region, the Midwest and East led with respective withdrawals of 25 Bcf, according to EIA. Pacific inventories fell by 9 Bcf, while Mountain region stocks declined by 5 Bcf.

The South Central region stood in contrast, posting an increase of 8 Bcf, which included an injection of 3 Bcf into nonsalt facilities and 5 Bcf in salts.

Rystad Energy analyst Ade Allen said mild temperatures and the lack of Freeport LNG export volumes through winter have allowed regional storage to build to “ominous” levels. The analyst explained that unusually high storage levels such as those in the South Central region threaten the market. Allen said supply growth is expected to outpace demand growth, and storage provides the buffer for excess supply during the summer months.

“If storage availability thins, prices would have to reach a level where operators will be forced to curtail production growth to balance the market,” Allen said.

The Pacific region, meanwhile, is a completely different story. Allen said the upcoming injection season would be crucial for the Pacific as deliverability remains diminished because regulatory changes have contracted working gas storage over the last few years.

Notably, California’s Aliso Canyon storage capacity is sharply below the 86 Bcf level at which it operated before a leak shuttered the facility in 2015. It now has a working capacity of 41 Bcf after state regulators voted unanimously in late 2021 to raise the capacity from the 34 Bcf maximum imposed after the leak.

There have been other significant changes to the storage situation in the region as well. Pacific Gas & Electric Corp. in the summer of 2021 reclassified a hefty 51 Bcf to base gas from working gas that it has been unable to replenish.

Along with harsh winter weather, supply issues and pipeline constraints, the drawdown in Southern California Gas inventories and struggling PG&E stocks have left Pacific storage overall more than 56% below the five-year average, according to EIA.

“West gas prices will continue to exhibit extreme volatility as the temperatures trend colder,” Allen said.

Total working gas in storage as of March 10 stood at 1,972 Bcf, which is 521 Bcf above year-earlier levels and 378 Bcf above the five-year average.

Macros In Focus

Heading into the shoulder season, there weren’t any significant price swings overall. U.S. markets generally aligned with the benchmark Henry Hub, where the declining demand outlook and stout supply situation continued to pressure prices.

Henry Hub’s April contract stood Wednesday at $2.442, off 10.0 cents through the week, according to Forward Look. The summer strip fell 16.0 cents to $2.820, and the winter 2023-2024 dropped 21.0 cents to $3.694.

Looking ahead to the spring, EBW said several factors could revive gas markets.

In addition to the modest contraction expected in the storage surplus given the chilly March outlook, EBW said feed gas demand for liquefied natural gas export facilities may increase as Freeport LNG returns to full service.

“Within the past 10 days, Freeport has consumed as much as 1.7 Bcf/d and as little as 0.2 Bcf/d – distorting any near-term pattern extrapolation,” said EBW’s Eli Rubin, senior energy analyst. “As demand likely steadies toward the higher end of the range, however, stronger LNG feed gas demand could similarly provide incremental support for slightly higher natural gas prices.”

In addition, a likely tapering in production growth could potentially reduce storage overflow fears and reset near-term Nymex futures higher, according to EBW. The firm noted that well completions have subsided across major upstream onshore plays since last fall. It is likely that a portion of easing activity is tied to seasonality and bursts of severe winter weather.

For its part, the EIA said in its latest Drilling Productivity Report (DPR), published last Monday, that total natural gas production from the Anadarko, Appalachia and Permian basins, as well as from the Bakken, Eagle Ford, Haynesville and Niobrara formations, would climb to 96.622 Bcf/d in April. That would represent a 420 MMcf/d sequential increase.

“Still, the rig count is down 33 rigs (4.4%) year-to-date,” Rubin said.

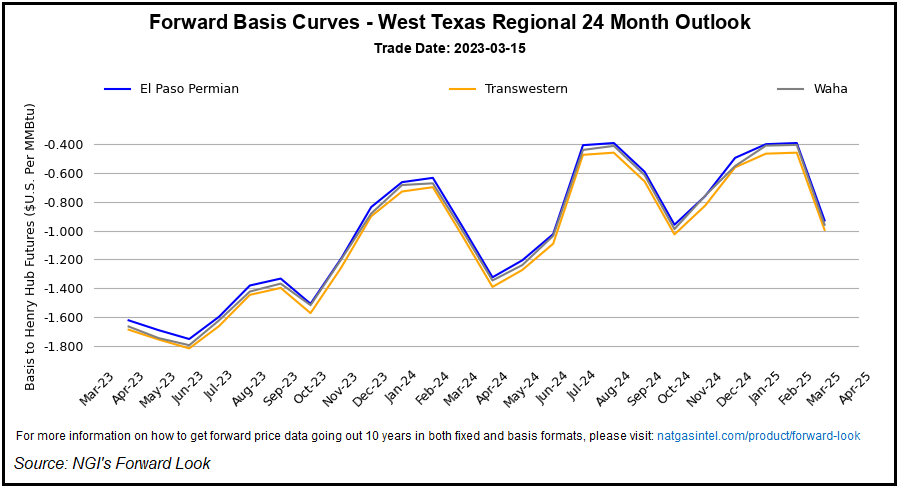

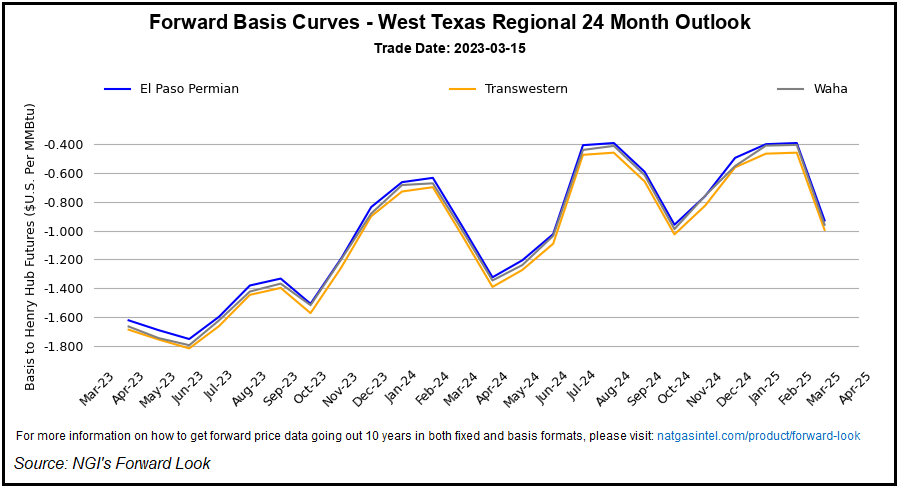

At the same time, pipeline constraints are likely to emerge as a physical limiting factor for supply during the spring maintenance season. The Permian-to-Gulf Coast pipeline, Gulf Coast Express, for example, is planning mid-April pipeline maintenance. This likely would cause a temporary plunge in Permian pricing and potentially a more durable increasing market focus on physical infrastructure limitations to supply growth, according to EBW.

Pricing at the Permian’s Waha Hub reflected the planned maintenance, with the April and May contracts moving lower in line with the rest of the country, but then advancing overall for the summer strip. The April-October strip climbed 9.0 cents through the period to average $1.220, according to Forward Look. Winter 2023-2024 prices, however, were 4.0 cents lower and averaged $2.800.

As for dry gas production, Rystad’s outlook expects volumes to grow by 3.7 Bcf/d (3.74%) in 2023. Incremental volumes are seen coming from the Haynesville and the Permian, though at a slower pace because of the tight pipeline capacity.

Rystad’s outlook for Haynesville dry gas production has evolved to a much flatter curve when compared with estimates from earlier in the year. Regional volumes are forecast to end the year around 16 Bcf/d.

“Appalachia is another region to monitor as we go into the summer injection season,” Allen said. “Operators usually go into maintenance, but with elevated storage levels keeping prices low and limited demand upside from incremental LNG exports, we expect increased competition with Gulf Coast volumes.”

Rystad expects Appalachia production to average 33 Bcf/d, or 427 MMcf/d lower than in 2022.

Published at Thu, 16 Mar 2023 13:10:28 -0700